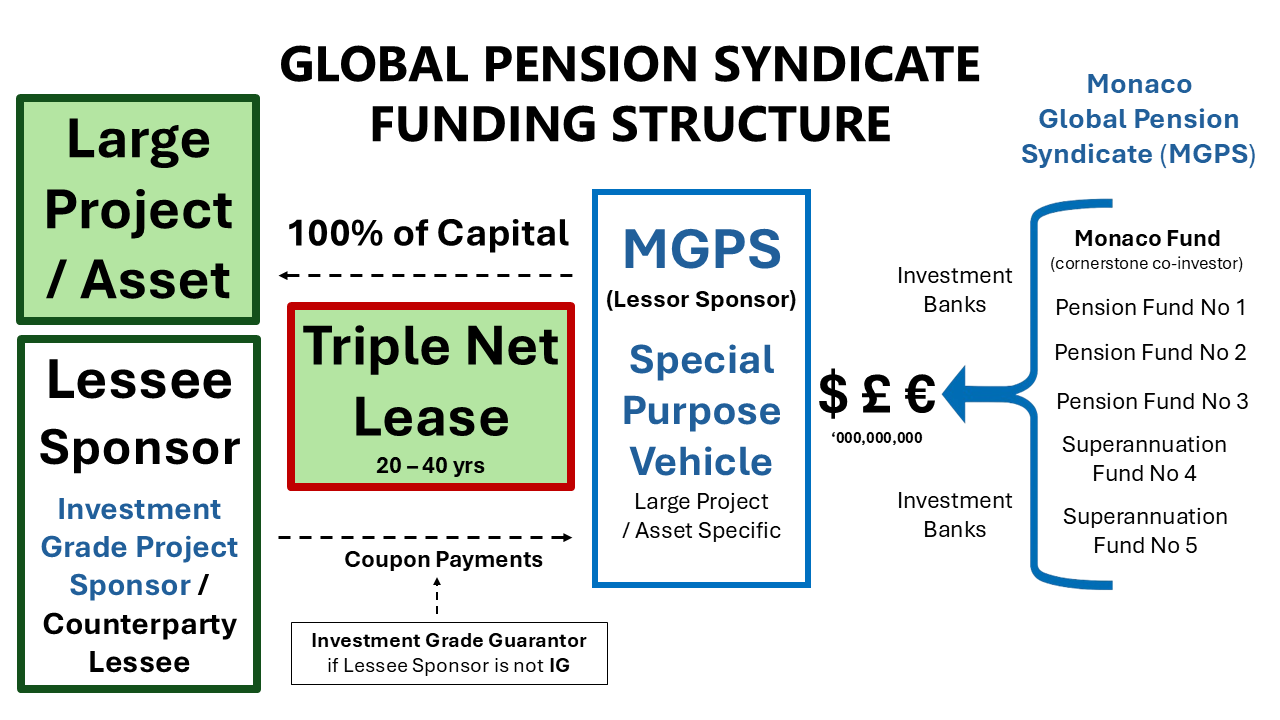

100% Equity Financing - without debt

Pension Fund Syndicates

USD $100m up to USD $3bn

Asset Financing

New Project Funding

Asset Sale & Leaseback

Triple Net Lease Structure

Funding Beneficiary is the “Lessee Sponsor”

Ownership

50% ownership accrual to Lessee Sponsor over lease term

Investment Grade

Under our funding model, the Lessee Sponsor or its guarantor must hold an investment grade rating from S&P or Moody’s to meet the strict credit requirements of global pension funds and institutional investors. This ensures that lease payment obligations are backed by a financially sound counterparty with a very low probability of default over the lease term.

Moody’s Ratings Baa3 or above

S&P Ratings BBB- or above

The rating provides long-term payment certainty, preserves investor confidence, and eliminates operational risk exposure by linking returns solely to the credit strength of the rated entity.

Using only S&P and Moody’s ratings creates a consistent, internationally recognized benchmark for credit quality, aligning with institutional standards worldwide.

Syndicate Policy on Disclosure & Attribution

It is standard international practice and a foundational element of the syndication framework that only institutional investors with majority economic exposure are entitled to public attribution and recognition. Minor co-investors, particularly private entities, are contractually prohibited from disclosing or promoting their participation in such transactions, as any public claim to involvement would distort the perception of funding responsibility and undermine the accountability and integrity of publicly sourced capital. In this context, where public pension funds constitute the overwhelming share of investment (as is always the case in each MGPS), it is impermissible for private minority investors to seek visibility or credit, ensuring that recognition aligns with and preserves the public trust inherent in taxpayer-supported investments.